As a tenant who’s watched the rental market soar over the last few years, you may be wondering if you would lose money as a homeowner or come out even. The answer can seem complicated as it involves your own personal finances, as well as rental costs that are out of your control.

By calculating the short-term costs and the long-term costs and benefits, you can determine if it’s time to buy your first home. Below, we offer insights and local stats that can help you decide if it’s time to buy a home in Minnesota or western Wisconsin.

Monthly payments

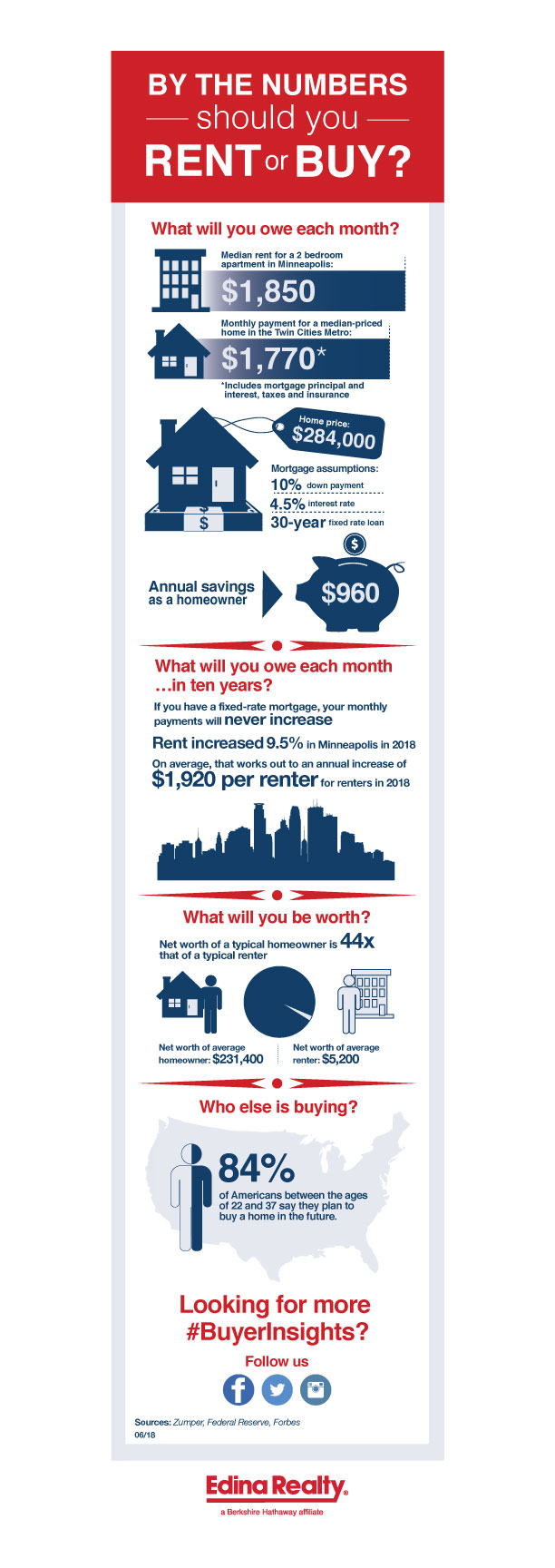

When talking about renting versus buying, it makes sense that the first comparison should be the average monthly expense of renters and homebuyers. According to Zumper, the median rent of a two-bedroom Minneapolis apartment as of June 2018 was $1,850.

Now let’s look at what it would cost to buy a median-priced home in the metro area, which in June 2018 was priced at $284,900. Assuming a homebuyer had a 10 percent down payment and good credit that would allow them to secure a 4.5 percent interest rate and a 30-year fixed rate mortgage, the homebuyer could pay around $1,770 per month for “PITI,” which encompasses:

- Principal:The monthly payment you make that reduces your outstanding mortgage balance

- Interest: The monthly payment you make that goes to the lender in exchange for the loan

- Taxes: The annual property tax rate for your home, divided into monthly payments

- Insurance: The payments you make toward homeowners’ insurance and any private mortgage insurance

In this example, the Minnesota homebuyer would come out just under the Minnesota renter, saving $80 a month.

To calculate your anticipated mortgage cost, use the Edina Realty Payment Calculator. If you are considering buying a condo or townhome, click on “advanced options” to add the anticipated homeowners’ association (HOA) fees.

Net worth

When monthly expenses are essentially a wash, it can be easy to put off buying a home, but when you look at the effects over the long-term, buying comes out ahead by a long shot.

A person’s home is usually their biggest investment and their greatest asset. According to the Federal Reserve’s Survey of Consumer Finances, which was last conducted in 2016, the net worth of typical homeowners is 44 times that of the net worth of the typical renter. Specifically, the average homeowner in 2016 had a net worth of over $230,000 while the average renter’s net worth was just over $5,000. (For reference, the median value of the homes owned at the time was $185,000.)

How does this happen? When you pay rent, you are contributing to your landlord’s mortgage (or if they own the property outright, it goes directly into their pocket). Meanwhile, as a homeowner, you are essentially paying into a long-term savings account that you can cash when you sell your home.

Payment increases

Another benefit of being a homeowner is that your monthly mortgage payment of principal and interest will not increase if you secure a fixed-rate mortgage. Meanwhile, renters are at the mercy of their landlords, who can typically raise the rent annually based on demand in the market.

Local rental data shows that:

- Rent on a two-bedroom apartment in Minneapolis rose 9.5 percent in 2018

- Rent on a one-bedroom apartment in Minneapolis rose 15.6 percent during that same time frame

This is a pretty drastic increase. When you calculate how that impacted renters in the last year, 1-bedroom renters saw an average annual increase of $2,280 and two-bedroom renters saw an average annual increase of $1,920.

While a large influx of renters can mean that your rental payment may increase from year to year, the monthly principal and interest payment on a fixed rate mortgage won’t increase — even if you pay it off over 30 years.

Rising trend

After years of spending thousands of dollars annually on rent, the millennial generation is finally entering the home buying market. This age group, generally agreed to be between the ages of 22 and 37, makes up nearly 29 percent of the U.S. population and came of age during the Great Recession.

As the economy improves and low interest rates hold, many millennials are entering the home buying market. According to a recent study, 80 percent of millennials say they plan to buy a home in the future.

While you shouldn’t do something simply because your peers are, it’s worth noting that the next generation of Americans hasn’t lost its interest in owning a home. Homeownership rates, which have already started to rise, are expected to grow in the next decade as millennials purchase their first properties.

100 percent freedom

Of course, not every pro and con can be weighed in objective terms. If you’ve ever looked around a rental and wished you could rip up the dingy carpet or put in a new light fixture, you should know that homeownership comes with the freedom to decorate and renovate to your heart’s content.

In the era of “upcycling” and Pinterest, it seems unusual not to have a home bucket list that includes everything from painting doors to creating open floor plans to refinishing a vintage dresser (or four).

Getting started

If you ran the numbers and you’re ready to enter the home buying market, call, email or chat today. We offer insights and guidance to homebuyers across Minnesota and western Wisconsin every day, and we’d love to start helping you.

Plus, don’t forget to share your real estate experiences with us on Facebook, Twitter, Instagram and YouTube using #BuyerInsights and #SellerInsights.